A very long time ago now, the husband and I were in a spot of financial bother. Neither of us earned very much, debts were managed rather than paid off… and then one of us lost our job… and so things began to spiral.

Having debt and money worries is a sickeningly heavy weight that darkens every waking hour of the day.

It’s an eternal thumbscrew, a metal lid on your brain that sits too tight and squeezes every thought.

And it’s a lesson that I think every one learns the hard way, and never ever forgets.

At least, that’s what I felt – and thought it was true for everyone else.

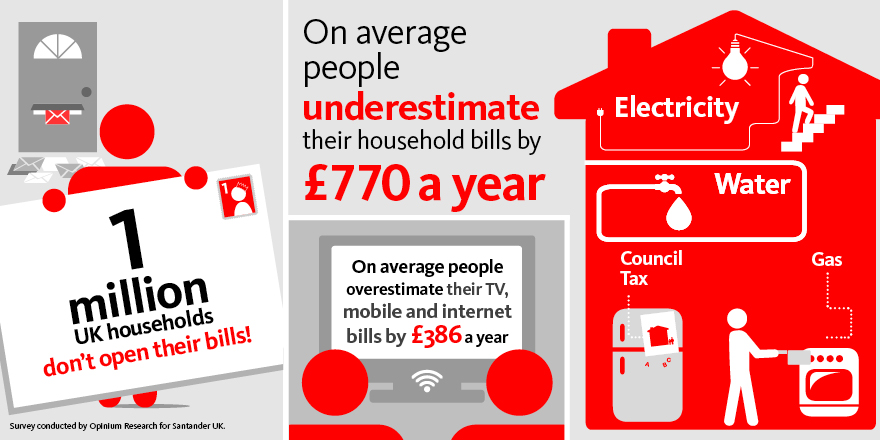

but then I saw this:

A MILLION UK households don’t open their bills?

Really?

Is that because they’re so comfortably off that it doesn’t matter what’s on the bill?

Or is it that sickeningly hot prickly fear that you just don’t want to know what’s inside? Hide it, and you don’t have to think about it?

I honestly don’t know – I’ve been in both situations financially; but either way I’ve always opened the bills!

Surely basic rule 101 of household financial management is knowing what your expenditure is?

Talk to anyone who has scrambled out of the debt pit, and they’ll say the solution is quite simple.

Hard work, determination, and sacrifice.

And careful tracking of every penny.

You don’t just blithely ignore the electricity bill, or presume your insurance is fine to just renew. You check to make sure you’re on the best rate, getting the best deal, couldn’t get an extra bonus by switching somewhere else. And you most certainly check to make sure the bill is accurate!

With the power of the internet at our fingertips, it’s easier than ever before. Sites like Money Saving Expert (seriously, if you’re looking at your household budgets than make good friends with this site and sign up for the newsletter, it’s an eye opener) are not only a font of the latest knowledge, but the forums are full of real people with help and advice to offer others. It’s easy to look for new energy suppliers if you use the comparison sites like uSwitch, and we’ve found simply picking up the phone and talking to other suppliers like BT and Sky have made a significant saving in our monthly payments as they know their products best and can offer useful advice.

Even when you’re shopping there’s basic ways to save. Check HUKD for latest deals and offers, My VoucherCodes for useful money-off coupons, and even things like bank accounts can offer the chance to save – the new Santander 1/2/3 Current Account offers cashback on certain household bills every month.

It was a long, tedious and VERY painful learning curve for us – but along the way we learned how to budget, how to manage, and how to feed the family, keep them warm and not lose the roof over their heads. We most certainly learned that you never solve a problem by hiding from it – looking it in the face is the only way to get on and deal with it.

Please people – open your bills!