I’ll never forget the day I turned 18, and was finally able to access the savings plan my parents had been paying into since I was born. Eighteen years of saving! It was going to be brilliant – I was about to get married (yes, really – five days later. And yes, we’re still married. So yah boo sucks to that thought you were just thinking) and had just bought a house (well, my older-and-actually-earning husband-to-be had), so this little savings nest egg could not have come at a better time.

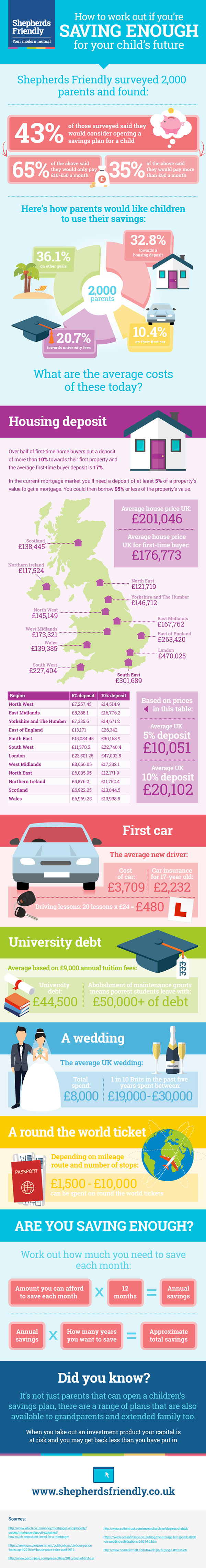

Are you saving enough for your child?

My parents were not wealthy – far from it. Over the years I’d watched them scrimp and save to afford to bring up their four children. I was last – and much later – in the line, and knew I’d had it easier than my older siblings. But back in the 70’s they’d planned ahead, set aside money every month so that i’d have some cash in my pocket to start me off on the right foot.

£132.

That’s how much I got – £132.

Now back in 1974, that was a lot of money – a month’s wages, probably, more than enough for a decent first car. But in 1992? Notsomuch.

The intentions were really good, of course, but when you’re saving you need to try and pull out your crystal ball. If your child is going to get access to that money in twenty years time, is it going to be worth the effort of saving? What seems to be a pretty nice amount now is rather inevitably going to be a whole heap more paltry when your child turns 18 in 2035.

But that’s not to say you shouldn’t bother – your savings could grow to be enough for your child to pay for driving lessons, or to cover a deposit on their first rented home.

If you have income enough to allow for savings, then it’s a great idea to have a fixed goal in mind, to really think about how to make the most of that money for your child. New research from money.co.uk, the price comparison site, reveals that parents wanting to cover the costs of your kids major milestones will need £259,000! Really, how is a family supposed to cover that? Especially if you have more than one child!

Lots of us would love to give our kids a head start in life – maybe by buying their first car, covering with university fees, or providing a large chunk of a housing deposit. However, for most of us it’s just not affordable unless we really have a good plan in place to save for their future, such as a dedicated children’s savings plan. But give yourself a specific goal – perhaps the first car – and those small savings can really help.

Money.co.uk discovered that 28% of parents admitted that saving wasn’t an option – it’s just a luxury lots of us cannot afford. However, there are saving options that could help you to save more for your child, such as a Junior ISA, where family and friends can also contribute on behalf of the child and any capital growth is tax free.

I love this handy infographic from Shepherds Friendly which really helps if you’re wonderings are you saving enough for your child?