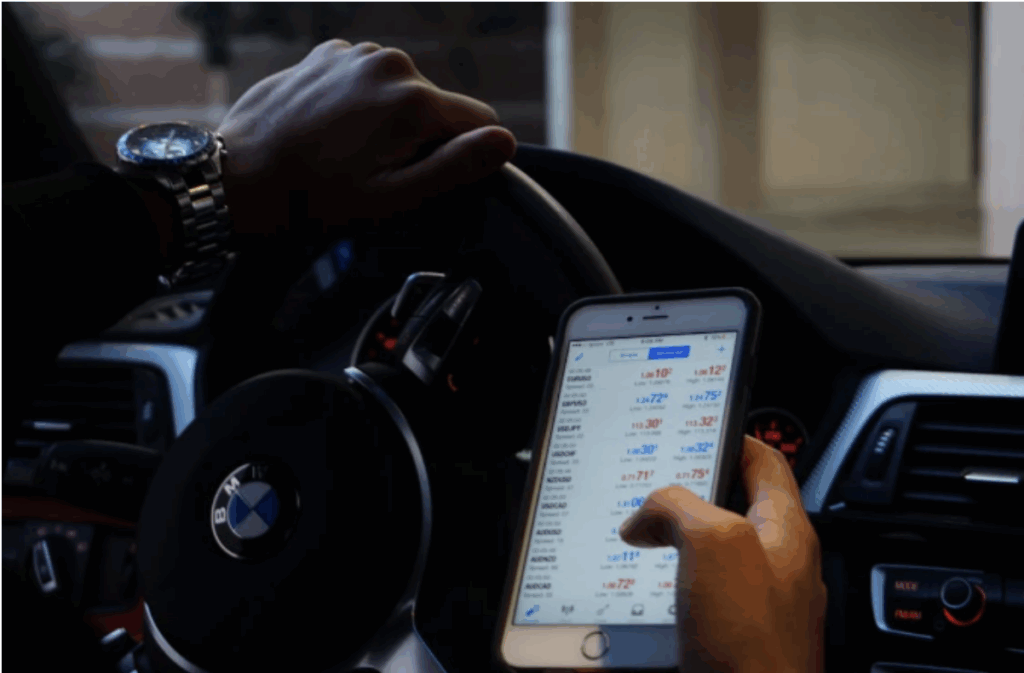

Financial management has, for a long period, been a challenge for digital nomads, global travelers, and expats. This is mainly because they need to constantly swap physical SIM cards, experience connectivity issues, deal with roaming fees, and face security risks while accessing banking services abroad.

That’s why many banks, businesses, and individuals are turning to eSIM. The eSIM technology enhances security and delivers real-time financial services without borders. Read on to learn more about how this technology is changing cross-border banking.

Embedded into travel fintech: how digital banks now include eSIMs to support borderless banking

As mentioned above, individuals traveling abroad often struggled with high roaming costs, juggling multiple SIM cards, and connectivity issues. This made digital banking a challenge for most. And that’s why leading digital banks recognized these pain points and are now transforming the travel fintech landscape by embedding eSIM support directly into their platforms.

For example, major digital banks, such as N26, now enable customers to purchase and activate travel eSIM data plans online. You can find all the details about the data plans here. These plans ensure that banking apps are accessible anywhere and anytime.

At the same time, they make it easy for individuals to integrate travel-friendly features such as fee-free international card payments, multi-currency spending, travel insurance, and access to airports. Another digital bank that has partnered with eSIM providers is Revolut. This partnership allows Revolut to embed global data connectivity alongside its finances.

Therefore, customers benefit by avoiding expensive roaming charges, maintaining banking service continuity, and leveraging digital banking benefits wherever they are in the world.

Instant remote provisioning: switch local operators with no physical SIM

One of the main advantages of the eSIM technology is that it allows instant remote provisioning. This feature enables users to switch mobile network operators anytime and anywhere without needing to physically swap SIM cards.

So, the eSIM technology ensures that you can switch to a local network operator after arriving in a new country, instantly and remotely. This eliminates the traditional wait times and logistics of purchasing, inserting, and activating a physical SIM card. Therefore, you can continuously enjoy internet connectivity without disruption.

But why does instant remote provisioning matter to cross-border banking? Well, that’s because of the following:

- It ensures immediate access to digital banking platforms after landing in a new country.

- It reduces the chances of banking fraud, which is a major security risk in physical SIM cards.

- It ensures users avoid expensive roaming charges. This makes the process of accessing digital banks more affordable.

- It enables neobanks to verify users remotely by linking eSIM numbers to accounts.

Reduced transaction friction: seamless currency exchanges and travel payments

Cross-border payments often come with many hidden costs and currency conversion delays. These issues cause transactional friction and make digital banking abroad frustrating. That’s why many neobanks are turning to eSIMs, and at the same time, they are encouraging their users to use eSIMs.

The eSIM technology ensures seamless currency exchanges and travel payments. It does that by doing the following:

Enabling instant network switching

As mentioned above, eSIM technology facilitates remote provisioning, which allows users to switch to local operators instantly without physically changing SIM cards. This feature ensures continuous mobile data connectivity to banking apps for live currency conversion and payment processing.

At the same time, it ensures that users avoid delays or failed transactions, which are common with roaming or physical SIM swaps.

Enabling multi-currency accounts

Digital banks such as N26, Bunq, and Revolut that use eSIM technology offer native multi-currency wallets. This feature, together with eSIM’s borderless mobile connectivity, enables users to effortlessly exchange currencies at competitive rates within the banking apps.

Also, they enable travelers to make payments in local currencies during travel. This ensures they can avoid costly fees because of slow or offline processes.

Enhancing security

eSIMs provide one of the safest ways for international travelers to access their banking apps. It comes with strong encryption and reduced risk of SIM-swapping fraud. Therefore, travelers can confidently perform sensitive currency exchange transactions and payments on trusted network connections.

Real-time compliance & KYC: streamlining verification without swapping SIMs

The eSIM technology makes the processes of Know Your Customer (KYC) and compliance more efficient than ever before. Traditionally, individuals needed to visit banks physically to submit all the required documents.

That’s not the case anymore. Today, there is the eKYC. It ensures that bank users can do the following online with their mobile device:

- Upload their government-issued IDs

- Provide biometric selfie comparisons

- Ensure real-time liveness checks

All that is possible through the eSIM. eSIM enables uninterrupted network access almost everywhere in the world. This lets users complete these KYC verifications immediately, regardless of location. At the same time, it helps reduce the risks of fraud and identity theft when traveling abroad.

And financial institutions and telecom providers can use the eKYC to comply with anti-money laundering, counter-terrorism financing, and other regulatory requirements efficiently. Therefore, eSIMs play an essential role in streamlining the verification process without requiring users to switch their SIM cards.

Future-proof infrastructure: why eSIM fits into open-finance ecosystems

The financial world is currently moving towards open banking and decentralized finance. This is where infrastructure needs to be flexible, secure, and globally accessible to ensure interoperability and real-time data sharing across borders.

And eSIM naturally fits into this vision. It has a digital and programmable nature that aligns perfectly with the demands of open-finance ecosystems, where users expect seamless integration across apps, banks, and borders.

What’s more, eSIMs fit into the open-finance ecosystems by:

- Allowing continuous and borderless mobile connectivity directly within fintech and banking apps. This enables open finance platforms to deliver an uninterrupted customer experience necessary for real-time payments, account management, and financial data access across regions.

- Supporting the diverse services of open finance ecosystems, including telecommunications, insurance, and payments.

- Enabling remote provisioning, which is essential in ensuring open finance platforms can serve multi-national customers reliably on local networks with minimal friction.

- Ensuring users stay verified, authenticated, and connected across multiple services.